What Is Slippage in Crypto? A Practical Guide to Avoid Trading Losses

You’ve done everything right: studied the charts, planned your entry precisely, and set a tight stop-loss with a favorable 2:1 risk-to-reward ratio. It’s the kind of setup every trader waits for. But the moment you hit “execute,” your order fills at a worse price than expected. Just like that, a well-planned trade starts in the red.

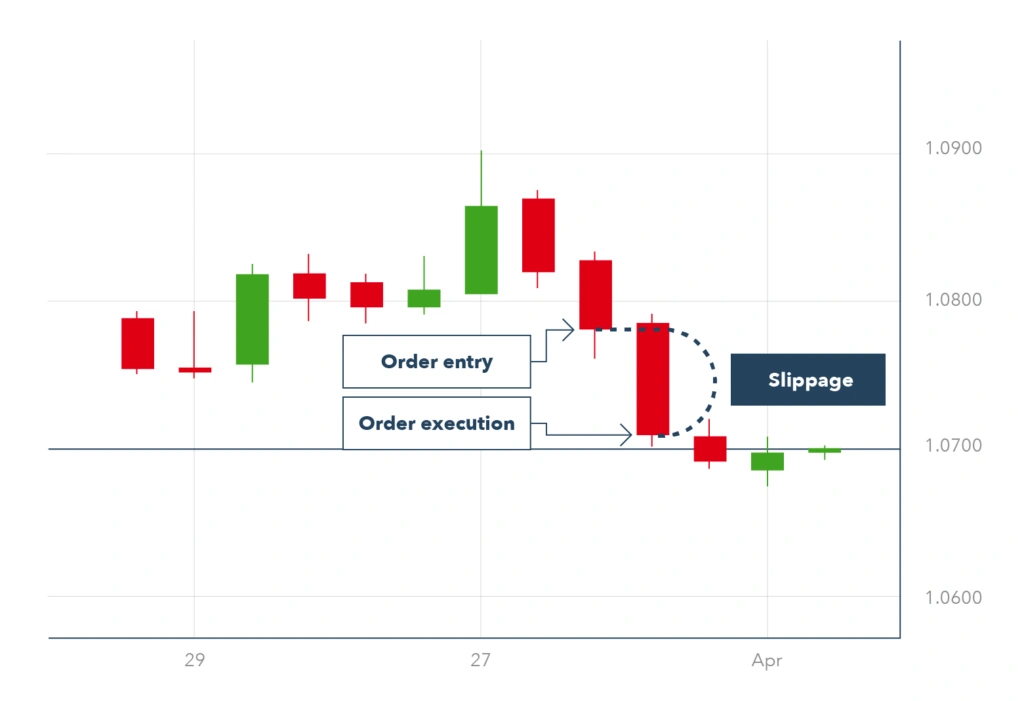

This frustrating phenomenon is known as slippage. In the world of crypto trading, even the slightest price discrepancy can undermine your strategy and impact your bottom line. Understanding what slippage is and how to manage it is essential for protecting your capital and maintaining consistency in your trades.

Slippage can be either positive or negative in the crypto market. Positive slippage occurs when a trade executes at a better price than expected, while negative slippage happens when you get a worse price. Think of it like seeing a price tag for $10 in a store, but by the time you get to the checkout, the price has changed to $12. This discrepancy is particularly common in volatile markets or with large orders.

In this comprehensive guide, you’ll discover exactly what causes slippage in crypto markets, how it affects your trading performance, and most importantly, eight actionable strategies to protect yourself from its negative effects. Whether you’re trading on centralized exchanges or navigating the complexities of DEXs like Uniswap, mastering slippage management is essential for consistent profitability.

What Is Slippage in Crypto? (The 1-Minute Explanation)

Simply put, slippage is the difference between the expected price of a trade and the actual price at which the trade is executed. This discrepancy isn’t a glitch or an error, but a fundamental feature of all financial markets, including cryptocurrency.

For instance, during the 2020 DeFi boom, slippage on Ethereum-based decentralized exchanges like Uniswap increased by over 200% due to network congestion and soaring gas fees.

Image Source: StealthEX

For prop traders, this concept is especially crucial because unexpected slippage can quickly eat into your allocated capital. If you’re trading with a firm like HyroTrader, excessive slippage might trigger your maximum daily loss limits, potentially ending your evaluation prematurely.

The phenomenon occurs in that millisecond gap between clicking “buy” or “sell” and when your order actually matches on an exchange’s server. In fast-moving crypto markets, prices rarely stand still for long.

Positive vs. negative slippage explained

Slippage works in two directions, and understanding both types is essential for accurate trade planning:

- Negative slippage occurs when you get a worse price than anticipated. For example, if you intend to buy ETH at $3,500 but your order fills at $3,510, you’ve experienced $10 of negative slippage. For sell orders, you might plan to sell SOL at $150 but it executes at $149.50, resulting in a $0.50 loss per token.

- Positive slippage, although less common, happens when your trade executes at a better price than expected. Imagine placing a buy order for Bitcoin at $60,000, but the price drops unexpectedly and you purchase it at $59,800, saving $200. For prop traders, this unexpected bonus can help offset negative slippage instances across your portfolio.

Quick analogy: Price tag vs. checkout price

To grasp slippage intuitively, think of it like shopping at a store. You spot an item with a $10 price tag, but by the time you reach the checkout, the price has changed to $12. That $2 difference represents slippage in action.

In crypto markets, this price difference happens much faster (often in milliseconds) but the principle remains identical. The price you see when placing an order isn’t guaranteed to be the price you actually get.

Why slippage matters in fast-moving markets

Slippage impacts all cryptocurrencies, though it’s less problematic for top-ranked coins with higher market caps and trading volumes. Bitcoin and Ethereum generally experience less slippage than smaller altcoins.

For prop traders, slippage is more than just an inconvenience; it’s a direct threat to your trading metrics. In digital asset arbitrage, for instance, even a 50-millisecond delay can mean the difference between profit and loss. A price shift during that brief moment can diminish or completely negate your expected returns.

Market volatility amplifies slippage risks. Cryptocurrencies are notorious for their extreme price fluctuations in very short periods. Additionally, speed becomes essential in mitigating slippage, especially when executing large orders that can quickly consume available liquidity.

Accounting for slippage is not a choice but a necessity in the world of prop trading. It can be the deciding factor between passing an evaluation and watching your capital erode.

Why Does Slippage Happen? The 3 Main Causes

Understanding slippage in crypto markets means recognizing the three fundamental causes behind this trading challenge.

Market Volatility: Price changes between order and execution

The crypto market’s notorious price swings create a perfect breeding ground for slippage. When prices fluctuate rapidly, the market can shift dramatically in the brief moment between placing your order and its execution.

Cryptocurrencies are known for their extreme volatility, with prices that can change significantly in very short periods. During sudden price spikes or drops, the execution price might differ substantially from what you initially saw on your screen.

Consider what happens during major market events: a single tweet from an influential figure or a surprise regulatory announcement can instantly amplify volatility, causing your order to execute at a completely different price than expected. The faster and more unpredictably prices move, the more likely you’ll encounter slippage that eats into your trading capital.

Low Liquidity: Not enough buyers/sellers at your price

In crypto markets with insufficient liquidity, your orders may not find enough counterparties at your desired price point. Consequently, your trade “eats through” the order book, matching with progressively worse prices until it’s filled.

This process closely resembles shopping at a market with limited inventory. Imagine wanting to buy 20 cupcakes at $2 each, but finding only 15 available at that price. To complete your order, you must purchase the remaining five at higher prices from other vendors – $3 each at one stall and $5 each at another. Similarly, in crypto trading, when there aren’t enough sellers at your preferred price, you’re forced to accept worse rates to complete your transaction.

Low trading volume often indicates reduced transaction numbers, which leads to more significant price swings. Higher trade volume typically translates to less slippage and greater stability, making major pairs like BTC/USD more forgiving for prop traders.

Network Latency & Congestion: Delays on blockchain or exchange

The third cause of slippage stems from technological limitations and network conditions. On centralized exchanges, latency or order-matching delays can cause price differences between what you see and what you get.

The situation becomes even more complex on decentralized exchanges (DEXs). Since DEXs use the blockchain to process trades, each transaction requires block confirmation. Before your transaction confirms, prices may change significantly, especially if the network is busy or block times are slow.

High network congestion, particularly on Ethereum, not only causes slippage but also delays transactions. During peak periods like the 2020 DeFi boom, network congestion led to slow transaction processing and increased gas fees, resulting in more significant slippage for traders.

For prop traders executing time-sensitive strategies, even a 50-millisecond delay can mean the difference between profit and loss. Such tiny delays can allow market conditions to shift enough to diminish or completely eliminate expected returns, potentially triggering stop-losses and damaging your evaluation metrics.

Slippage in a Prop Trading Context: Why It’s Critical

For prop traders, slippage isn’t just a minor hiccup. If ignored, it can seriously hurt your chances of passing the evaluation process. Unlike retail traders who only risk their own capital, prop traders operate under strict evaluation metrics that can terminate their access with a single bad day.

How slippage can trigger a maximum daily loss

Prop trading firms enforce strict risk parameters, such as maximum daily loss limits, to ensure disciplined trading. In such a setup, negative slippage can become a silent threat, quickly eating into your capital and pushing you closer to those predefined thresholds.

For instance, if you place a large market order for ETH during a period of high volatility, you could encounter slippage of 1% or more, which may significantly impact your position size and overall drawdown. On a $10,000 position, that’s an immediate $100 loss before your trade even begins.

Moreover, unexpected slippage can trigger stop losses at unintended prices, compounding losses in a cascading fashion. Even a delay of just a few milliseconds can completely wipe out expected returns on time-sensitive strategies.

Impact on maximum trailing drawdown

Beyond daily limits, prop firms track your maximum trailing drawdown, the most significant peak-to-trough decline in account value. Persistent slippage gradually erodes your metrics, even when individual instances seem minor.

For this reason, prop traders should include anticipated slippage in backtesting. Without accounting for this real-world execution cost, your strategy may appear profitable on paper yet fail in live trading.

CEX vs. DEX: Which is safer for prop traders?

Centralized exchanges (CEXs) typically offer lower slippage than decentralized alternatives thanks to higher liquidity and faster execution. However, DEXs provide transparency that some prop traders prefer.

On CEXs, market volatility and order book depth primarily drive slippage. Meanwhile, DEXs face additional challenges from blockchain confirmation times and gas fees, potentially increasing execution delays.

Ultimately, CEXs prove safer for prop traders handling large positions in volatile markets, whereas DEXs might offer advantages for smaller trades in stable conditions.

Uniswap slippage and tolerance settings explained

On the Uniswap platform, you can configure slippage tolerance. The maximum acceptable price difference between the quote and the execution. The platform automatically sets this between 0.1% and 5% depending on network conditions and swap size.

To manually adjust tolerance:

- Select the settings icon

- Click the slippage dropdown

- Switch from “Auto” to “Custom” tolerance

Be cautious: setting tolerance too low may cause transaction failure, while setting it too high could result in receiving significantly fewer tokens than expected. For instance, a 25% tolerance could mean receiving 25% fewer tokens than shown in your swap preview.

Remember that slippage tolerance directly affects execution certainty – the higher your tolerance, the more likely your trade will complete, albeit potentially at worse prices.

How to Avoid (and Minimize) Crypto Slippage: 8 Actionable Strategies

Mastering slippage management requires specific techniques that protect your trading capital. These eight strategies will help you minimize price discrepancies and avoid triggering maximum daily loss limits during your prop firm evaluation.

Use limit orders instead of market orders

Limit orders specify the exact price at which you’re willing to buy or sell, effectively eliminating negative slippage. Unlike market orders that execute immediately at available prices, limit orders only fill at your specified price or better. This control comes with a trade-off: your order might not fill if the market never reaches your limit price.

Set slippage tolerance manually on DEXs

On decentralized exchanges, customize your slippage tolerance based on token liquidity and volatility. Start with conservative settings (0.5-1%) and increase only when necessary. This prevents transactions from failing while protecting you from excessive price movement.

Trade high-liquidity pairs like BTC/USD

Focus on major cryptocurrencies with deeper order books and higher trading volumes. BTC/ETH pairs typically offer tighter spreads and minimal slippage compared to exotic or low-cap altcoins.

Break large orders into smaller chunks

Dividing substantial trades into smaller portions prevents moving the market against yourself. This technique reduces market impact and helps achieve better average prices. Professional traders use algorithmic execution strategies that spread orders across time.

Trade during peak liquidity hours

Execute trades during market overlaps between regions, particularly the European-American window (13:00-16:00 UTC), which shows 31% higher volume than daily averages. These “golden hours” create ideal conditions for larger trades with reduced slippage.

Avoid trading during major news events

Slippage often spikes during significant announcements or fast market movements. Consider holding off during these periods or adjusting your strategy with reduced position sizes.

Check order book depth before placing trades

Analyze the order book to gauge available liquidity at different price levels. A “deep” book has large buy and sell orders clustered around current prices, indicating high liquidity and minimal slippage risk.

Factor slippage into your risk calculation

Include anticipated slippage in your position sizing and risk assessment. Slippage can distort your calculations, making your margin buffer seem safer than it actually is. This false security can lead to reckless position sizing, one of the fastest ways to blow your account.

As a prop trader, understanding the nuances of slippage can make the difference between passing and failing your evaluation. Here are some final key takeaways to give you a well-rounded understanding of slippage and how to manage it.

Is slippage always bad?

Surprisingly, slippage isn’t always a bad thing for your trades. Positive slippage occurs when market movements favor your execution, giving you a better price than expected. For instance, when placing a buy order for Bitcoin at $50,000 and executing at $49,800, you’ve gained $200 through positive slippage. Nevertheless, most traders focus primarily on avoiding negative slippage, which erodes profit margins. The distribution between positive and negative slippage depends on market direction, timing, and overall conditions.

Can you completely avoid slippage?

Despite your best efforts, slippage cannot be entirely eliminated from crypto trading. It’s a regular part of market mechanics, occurring due to the fundamental way orders are filled. Nonetheless, you can significantly minimize its impact through strategic approaches. Using limit orders instead of market orders prevents trades from executing at unfavorable prices. Indeed, trading during periods of high liquidity and avoiding major news events typically reduces slippage vulnerability.

How do I calculate slippage percentage?

Calculating slippage percentage requires three simple steps:

- Identify your expected price at order placement

- Record the actual execution price

- Apply the formula: Slippage (%) = ((Actual Price − Expected Price) / Expected Price) × 100

For example, if you expected to buy Solana at $130 but paid $125, your slippage would be: ((125 – 130) / 130) × 100 = -3.8%. This calculation helps quantify trading costs and adjust risk management accordingly.

Conclusion

Slippage remains an unavoidable reality of crypto trading, though its impact on your bottom line can certainly be controlled. This guide shows how even minor price discrepancies between expected and executed trades can quickly accumulate, potentially triggering maximum daily loss limits and threatening your prop trading career.

While positive slippage occasionally works in your favor, negative slippage demands your full attention and preparation. Market volatility, low liquidity, and network congestion all contribute to this challenge, making strategic planning essential rather than optional.

The eight strategies outlined above offer practical solutions you can implement immediately. Limit orders, manual slippage tolerance settings, trading high-liquidity pairs, and breaking large orders into smaller chunks stand as your first line of defense. Additionally, timing your trades during peak liquidity hours, avoiding major news events, checking order book depth, and factoring slippage into risk calculations will significantly improve your execution quality.

Now that you understand how to manage slippage, you’re one step closer to getting funded. Read our in-depth reviews of the best crypto prop trading firms to find the right fit for your strategy.