How to Start Crypto Prop Trading in Six Steps

In recent years, the world of crypto trading has evolved rapidly. Retail traders looking to scale their operations without risking significant personal capital are turning to proprietary trading firms, commonly known as prop firms. Crypto prop trading allows skilled traders to access large sums of capital provided by a firm in exchange for a share of the profits. This arrangement removes the barrier of undercapitalization while enforcing disciplined risk management practices.

In this comprehensive guide, you will discover how to start crypto prop trading, navigate the evaluation process, select the best firm for your style, and implement the strategies that drive consistent profitability. By the end, you will understand the full journey from signing up for a challenge to earning a stable income as a funded crypto trader.

What Is Crypto Prop Trading?

Crypto proprietary trading involves using a firm’s capital to trade digital assets such as Bitcoin, Ethereum, and various altcoins. Rather than risking your own money, you undergo an evaluation phase or challenge designed to assess your trading skills and risk management abilities.

Once you pass the challenge, the prop firm funds your account, often in denominations ranging from ten thousand dollars to two hundred thousand dollars or more. You then trade under the firm’s rules and keep a significant percentage of the profits you generate. Profit split arrangements commonly range from 70%-90% in favor of the trader, with the remainder retained by the firm as payment for providing capital and infrastructure.

This model provides several advantages. First, traders gain access to far greater capital than they typically have on their own, enabling them to employ strategies that require scale. Second, prop firms enforce strict risk management rules, including daily loss limits and maximum drawdowns, which foster discipline and protect both the trader and the firm’s capital. Third, traders can focus on refining their edge rather than raising funds, since the firm supplies the capital.

Why Crypto Prop Trading Is Gaining Popularity

Several factors drive the rise of crypto prop trading. The first driver is access to institutional-quality capital. Most retail traders have only a few hundred or a few thousand dollars to work with, which severely limits the strategies they can deploy. With prop trading, the barrier is removed and traders can operate on a larger scale. The second driver is the adoption of professional risk controls.

Prop firms enforce rules such as maximum daily drawdown, trailing drawdown, position limits, and prohibited activities like unauthorized news trading. By embedding these constraints, firms ensure traders learn responsible money management. The third driver is the transparency and community aspects that prop firms often provide. Many have active Discord or Telegram groups, public leaderboards, and regular performance summaries that build trust and offer peer support.

Another significant reason for the growth of crypto prop trading is the 24/7 nature of cryptocurrency markets. Unlike traditional equity or forex markets that close on weekends, crypto markets remain open at all hours. This availability appeals to traders in various time zones and supports multiple trading styles, including day trading and swing trading.

Core Concepts in Crypto Prop Trading

To succeed in crypto prop trading, you must master several core concepts that govern most prop firm programs. Understanding these concepts is critical because they form the foundation for structuring challenges and managing funded accounts.

One of the most important concepts is risk management, often formalized through daily loss limits or daily drawdown rules. For example, suppose a prop firm imposes a 5% daily drawdown limit on a $100K evaluation account. In that case, you cannot lose more than five thousand dollars in any single day. Exceeding this threshold results in instant disqualification from the challenge.

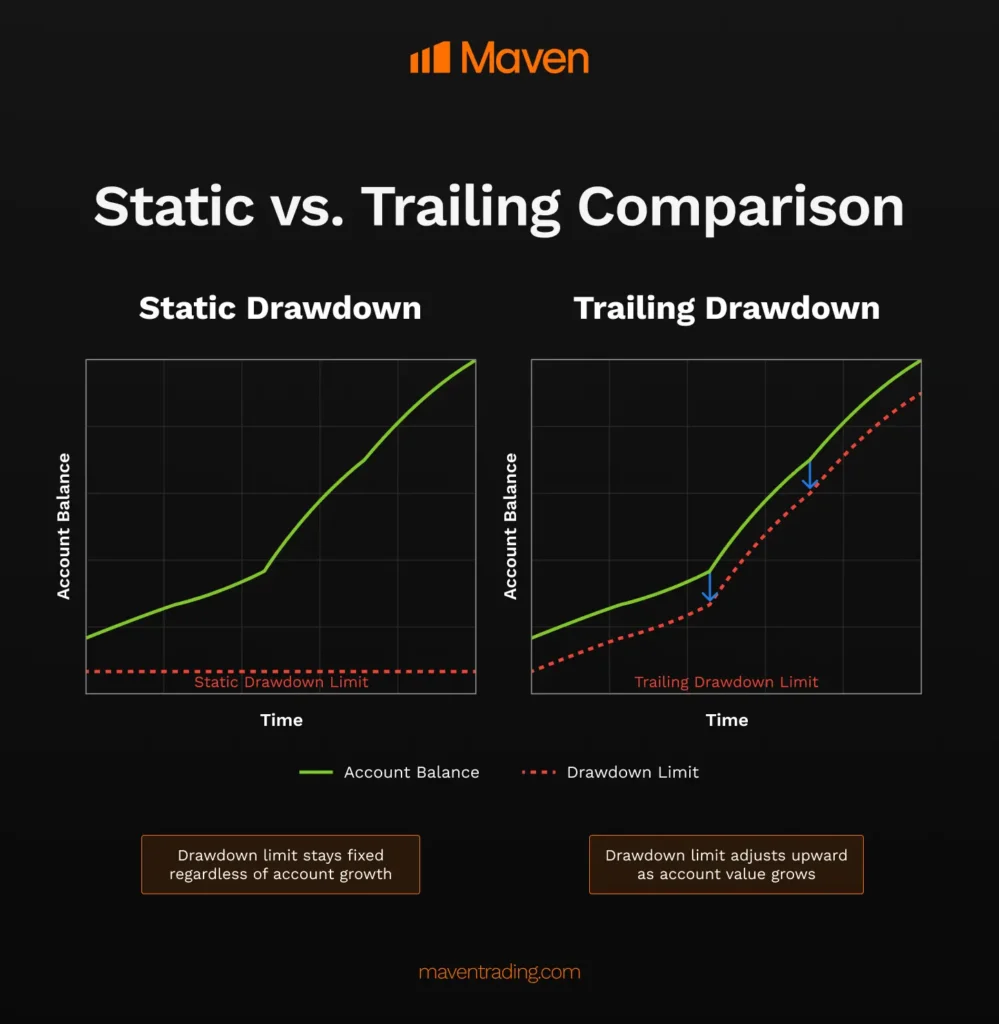

Another related concept is the maximum trailing drawdown. Unlike a static loss limit, a trailing drawdown moves upward as your equity grows. If your account balance peaks at one hundred ten thousand dollars with a 10% trailing drawdown, your drawdown limit becomes ninety-nine thousand dollars; dropping below that level ends the challenge.

Difference between static drawdown & trailing drawdown, Source: Maven

Profit targets define the return you must generate to pass the evaluation. Typical targets range from eight to 10% for a one-step challenge, or a staged approach such as 10% in phase one and 5% in phase two. Consistency requirements ensure that traders cannot simply rely on a single large gain but must demonstrate steady performance over multiple trading days. For instance, a firm may state that no single day’s profit may exceed 40% of total profits, encouraging traders to spread gains over time.

Another key concept is the profit split. Once funded, you share profits with the firm based on a predefined ratio. A common split is 80-20 in favor of the trader, though some firms offer 70-30 splits or even ninety-ten splits for top performers. Understanding how this split works and how it impacts your take-home earnings is crucial when choosing a firm.

Lastly, scaling plans reward traders who consistently perform to a high standard. After reaching certain profit milestones, your account size may increase. This incremental growth allows you to manage more significant sums of capital, thereby amplifying your earnings potential. Many traders view scaling plans as a path to a sustainable trading career, transforming a modest one hundred thousand dollar account into a multi-hundred-thousand-dollar or even million-dollar operation over time.

How to Start Crypto Prop Trading: Step-by-Step Guide

To succeed, you’ll need more than just a good strategy; you also need a structured approach. This detailed guide will walk you through the critical phases to help you start strong and stay consistent.

1. Evaluate Your Readiness

Before applying to any prop firm, conduct a thorough self-assessment. Evaluate your recent trading performance in demo or small live accounts. Are you consistently profitable over a period of at least three months? Do you have a clear trading plan that includes entry criteria, exit rules, and position sizing? Can you maintain discipline during losing streaks and avoid revenge trading? Emotional stability is as important as technical skill. Prop trading challenges will test your ability to stick to your rules under pressure.

Consider your trading style. If you are a scalper who executes dozens of trades per day, you will need a low-latency platform and a firm that permits high-frequency trading. If you are a swing trader who holds positions for several days, choose firms with flexible hold policies and no weekend or overnight restrictions. Understanding your style helps you match with the right firm and program.

2. Research and Select a Crypto Prop Firm

The next step is researching prop firms and selecting one that aligns with your needs and strategy. Key factors to compare include profit split ratios, challenge fees, evaluation phases, drawdown rules, platform compatibility, asset availability, and scaling plans. Look for firms that focus on crypto futures trading with reputable exchanges such as Binance Futures, Bybit, or OKX. Alternatively, some firms offer proprietary platforms integrated with TradingView or MetaTrader 5.

Transparency is a hallmark of reputable firms. Read the fine print to understand refund policies, fee structures, and rule violations. Search for public payout proofs, user testimonials on Trustpilot or Reddit, and developer or community roadmaps. A strong online presence and responsive customer support via Telegram or Discord are additional indicators of legitimacy.

Stay wary of firms that promise guaranteed profits or downplay risks. Crypto prop trading is risky by nature, and even the best traders face losses. The right firm will be honest about risk and require you to pass a challenging evaluation.

3. Prepare Your Trading Strategy

Once you have chosen a firm, prepare your trading strategy and thoroughly backtest it against historical market data. Whether you prefer trend following, mean reversion, breakout trading, or news-based volatility strategies, ensure your system performs well across bull, bear, and sideways markets. Backtesting should cover a minimum of one year of price data, and forward testing should be conducted in a demo environment that mirrors the prop firm’s risk rules.

Position sizing is a critical component. Most firms enforce a 1% risk per trade rule, which means you risk no more than 1% of your account equity on any single trade. With a $100K account, this translates to one thousand dollars per position. Stop-loss orders are non-negotiable, and trading without them often results in disqualification.

Keep a detailed trading journal, recording every trade, including entry and exit prices, rationale, risk amount, and emotional state. Reviewing your journal reveals patterns in your performance and helps you refine your approach.

4. Sign Up for the Evaluation Challenge

When you feel confident in your strategy and risk management, sign up for the prop trading challenge. Fees vary but typically range from fifty to three hundred dollars. Some firms offer one-step evaluations where you must reach 10% profit with a 5% daily drawdown limit. Others provide two-phase challenges to gradually test different aspects of your trading.

During the challenge, trade as if it were a live funded account. Avoid deviating from your tested strategy and resist the temptation to chase targets. If you violate rules or fail to hit the profit target within the time limit, you will be disqualified and lose your fee, though many firms allow discounted retries or free resets if you demonstrate rule compliance without reaching profit targets.

5. Pass the Challenge and Begin Funded Trading

Once you pass the evaluation, you are awarded a funded account. At this stage, you trade real money under the firm’s rules and receive regular payouts, usually on a biweekly or monthly schedule. Stick diligently to your plan, maintain position sizing, and continue journaling trades. Any rule violation, such as hitting your drawdown limits or holding unauthorized positions, will result in account closure.

Funded accounts often come with slightly different conditions than evaluations, including stricter monitoring, reduced timeframes, or minimum trading days. Familiarize yourself with these changes before the challenge ends so you can transition smoothly.

6. Scale Your Account Over Time

After proving consistent performance, take advantage of scaling plans. Meet the firm’s performance milestones, such as 10% profit in sixty days without breaching risk limits, and your capital allocation increases by 25%-100%. Over multiple cycles, advanced traders can grow from a $100K account to a $500K or even a million-dollar account. Scaling dramatically amplifies both your earning potential and the importance of strict risk control.

Detailed Evaluation: Key Metrics and Rules

Crypto prop trading challenges hinge on several key metrics and rules that every trader must understand:

Profit Target: This is the percentage gain you must achieve to pass. A 10% target on a $100K account requires a $10K gain. Achieving this consistently is challenging and requires precise trade management.

Daily Drawdown: Breaking your daily loss limit, such as 5% of account equity, ends the challenge immediately. This rule exists to test stop-loss adherence and discourage reckless trading.

Max Trailing Drawdown: Unlike static drawdown, trailing drawdown moves up as your peak equity grows. For example, if your account peaks at one hundred ten thousand dollars and the trailing drawdown rule is 10%, your allowable loss threshold is ninety-nine thousand dollars. A balance below that amount results in failure.

Minimum Trading Days: Some firms require you to place trades on a minimum number of days, often five. This prevents traders from hitting targets on a single lucky day.

Position Size Limits: Firms often cap position sizes or require you to risk no more than 1% of equity per trade. This prevents outsized bets and ensures longevity.

Strategy Restrictions: Certain strategies, such as martingale or grid trading, may be prohibited. News-based trading during high-impact events can also be restricted if firms want to avoid event-driven risk.

Understanding these metrics and rules thoroughly before starting ensures you are not caught off guard during the challenge.

How to Evaluate Crypto Prop Firms: A Complete Checklist

One of the most common questions traders ask is: Are crypto prop firms legitimate? The truth is, legitimacy varies significantly across the space. While there are several well-established firms offering real funding, timely payouts, and vibrant trader communities, there are also less reputable or outright fraudulent ones.

That’s why selecting the right crypto prop firm isn’t just about picking the one with the highest profit split or the lowest fee. It requires a thorough evaluation of various criteria to ensure the firm aligns with your trading style, strategy, and risk appetite.

Below is a detailed checklist to guide your due diligence:

- Rule Transparency: Start by checking whether the firm clearly outlines its risk parameters, profit targets, daily and overall drawdown limits, payout procedures, and fee structure. A reputable firm won’t bury this information in fine print. If it’s hard to find or confusing, that’s a red flag.

- Community Feedback: Dig into reviews and feedback on trusted platforms like Trustpilot, Reddit, X (Twitter), and Discord. Pay attention to user experiences with payouts, challenge processes, and customer support responsiveness. Screenshots of payouts and real trading dashboards shared by users can serve as useful evidence of legitimacy.

- Funded Account Options: Does the firm offer a range of account sizes to accommodate various trader profiles? Whether you’re a part-time scalper or a full-time swing trader, having account size flexibility is essential to match your position sizing and risk management preferences.

- Profit Split Structure: Review how much of your profit you get to keep. Splits can range from 70% to 90%, with some firms offering even higher percentages through loyalty programs or performance tiers. A higher split means more rewards for consistent performance, but make sure it’s not offset by higher fees elsewhere.

- Evaluation Costs and Refunds: Understand the pricing structure for evaluation challenges. Some firms offer refundable fees if you pass the challenge, while others provide discounted resets or second chances. Compare these offerings carefully, especially if you plan to attempt multiple evaluations.

- Platform Integration: Check whether the firm supports the platforms you’re comfortable using, such as MetaTrader 4/5, TradingView, or direct crypto exchange APIs. The ability to execute trades on familiar software can directly impact your performance and confidence.

- Asset Scope: Examine the range of tradable assets. Some firms focus exclusively on perpetual futures on BTC and ETH, while others provide access to a broader range of altcoins, spot pairs, and even synthetic indices. Choose a firm whose instruments match your trading strategy.

- Payout Frequency and Method: How often do traders get paid: weekly, biweekly, or monthly? Also, verify whether the payouts are made in stablecoins, native crypto like BTC/ETH, or fiat via bank transfer. Ensure the payment methods are secure, fast, and suited to your financial setup.

- Compare Firms Easily: To simplify this evaluation process, you can use our platform which is one of the best crypto prop firms comparison tool out there. Filter firms by profit splits, account sizes, platform support, and more to find the one that fits your trading goals.

By methodically working through this checklist and leveraging comparison tools, you’ll significantly improve your odds of partnering with a reputable, high-quality firm that supports your long-term success as a funded trader.

How to Implement a Winning Strategy

Once you’ve chosen a prop firm, the next step is executing a well-defined trading strategy that not only passes the evaluation phase but also thrives during funded trading.

Start by clearly defining your edge, whether it’s capitalizing on trend reversals, breakout momentum, or mean reversion. Understand what gives your strategy an advantage and under which market conditions it works best.

Backtest your strategy thoroughly using at least one year of historical data. This should cover different market phases including bull runs, crashes, and sideways trends. Focus on metrics such as win rate, average risk-to-reward, profit factor, and maximum drawdown.

Forward testing is just as important. Use a demo account with the same rules and risk parameters as the prop firm. This step helps uncover any real-time execution problems and psychological triggers that may not show up in a backtest.

Stick to disciplined position sizing. Risk no more than 1% per trade, adjusting your lot size accordingly. Consistency in position sizing protects you from drawdowns and helps stay within firm-mandated limits.

Maintain a detailed trading journal. Record not just entries and exits, but your emotional state, decision-making process, and whether you followed your rules. Regularly reviewing this journal will help improve self-discipline and uncover patterns in behavior or performance.

Finally, commit to continuous improvement. No strategy is future-proof. As markets evolve, so should your system. Analyze your journal monthly, tweak variables as needed, and stay open to refining your edge without abandoning its core principles.

Can Bots or Expert Advisors be Used in Crypto Prop Trading?

Many traders exploring crypto prop firms are curious about whether they can use automated trading systems like bots or Expert Advisors (EAs). The short answer is yes, but it heavily depends on the firm. Some crypto prop firms explicitly allow algorithmic trading through platforms like MetaTrader 4/5 or cTrader, allowing traders to automate strategies that align with their edge. However, this isn’t universal. While automation can significantly enhance consistency and reduce emotional bias, prop firms enforce strict controls to prevent exploitation.

For example, your bot might need to be submitted for approval before use, particularly to ensure it doesn’t rely on latency arbitrage, quote stuffing, or pricing glitches. Additionally, if your bot interacts with illiquid markets or triggers slippage in ways that challenge the firm’s internal risk model, it might be disqualified. Always verify whether the firm supports automated trading, and if so, understand the exact terms and technical parameters involved.

What Happens When You Fail the Challenge

Failing a prop firm challenge can be disappointing, especially after investing time and an upfront fee, but it’s a common part of the journey. Typically, challenges have strict rules around drawdown limits and profit targets. Violating any of these usually results in immediate termination of your challenge account. In most cases, the fee you paid is non-refundable.

That said, several reputable crypto prop firms offer discounted retry options, unlimited resets, or even second chances through promo events. The key takeaway here is that failure isn’t the end, it’s data. Use it to review your trades, journal your psychological decisions, and adjust your risk or position sizing. Many traders fail their first evaluation, only to pass later with refined strategies. Consider every failed challenge as a tuition fee for your future trading education.

How Much Money Can Realistically Be Made

The earning potential in crypto prop trading is enticing but varies dramatically depending on your trading skill, the size of the funded account, your profit split, and consistency. Let’s break it down with a concrete example. Suppose you get funded with a $100,000 account and the firm offers an 80% profit split. If you earn a conservative 5% monthly return, that’s $5,000 profit, of which you keep $4,000.

For skilled traders who can consistently generate 10% returns, the take-home pay could be $8,000 per month. Part-time or more risk-averse traders aiming for a 2% return would still earn $1,600 monthly on a $100,000 account.

Over time, many prop firms offer scaling plans that increase your capital allocation as you demonstrate consistency and risk management, allowing you to make more without taking on more personal risk. However, it’s vital to stay grounded as trading performance varies monthly, and drawdowns are inevitable.

Do I Have to Pay Taxes on Prop Firm Income?

Yes, income from prop firm payouts is taxable. While tax laws vary by country, in most jurisdictions, you are required to report your earnings from trading, whether they are structured as payouts, commissions, or profit splits.

In the United States, for example, such income is often treated as self-employment income or capital gains, depending on the setup. This means you may be liable for federal and state income taxes, and possibly self-employment taxes as well.

It is advisable to maintain accurate records of all payouts, including invoices, emails, and bank receipts. Consulting a qualified tax professional ensures that you remain compliant and can take advantage of any deductions available to traders. For official guidelines, refer to authoritative sources like the IRS page on digital assets.

Final Thoughts

Starting crypto prop trading in this age involves more than just signing up. It requires thorough preparation, disciplined strategy development, and careful firm selection. By mastering the concepts of drawdowns, profit splits, and risk management, you set yourself on a path to become a consistently funded trader. Remember that success is built on a foundation of emotional control, continuous learning, and strict adherence to rules.

Ready to find the firm that matches your trading style? Check out our platform to filter and compare crypto prop trading firms by rules, assets, and more via CryptoPropTrader.com.

Financial Risk Disclaimer:

Trading cryptocurrencies and participating in proprietary trading programs involve significant risk. This article is for educational purposes only and does not constitute financial advice. Always consult a licensed financial advisor before making trading or investment decisions.