How to Make Money Trading Crypto: A Guide for Serious Traders

The cryptocurrency market is worth more than $2 trillion, making it a prime opportunity for those who know how to make money trading crypto. However, cryptocurrency is also a speculative investment with potential for significant gains and a high risk of losses. This volatility creates opportunities and challenges for traders looking to capitalize on price movements.

Whether you’re drawn to cryptocurrency for its volatility and high reward potential or seeking to make a consistent $100 daily from trading, success requires more than luck – it demands strategy and discipline. In fact, the cryptocurrency space operates 24/7 globally, creating frequent and significant price variations that savvy traders can leverage.

In this comprehensive guide, we’ve created a clear “Trader’s Pathway” that takes you from foundational, lower-risk strategies to advanced trading techniques. Unlike other resources that offer surface-level tips, we dive deep into actionable methods, including crypto prop trading, a capital-efficient pathway for skilled traders who lack significant starting capital. From dollar-cost averaging to day trading, we’ll explore proven approaches that serious traders use to navigate this dynamic market in 2025.

Can You Really Make Money Trading Crypto? Let’s Be Honest

Contrary to what crypto influencers might suggest, making money trading cryptocurrency requires more than downloading an app and following social media tips. Let’s examine what the data actually tells us about crypto trading success.

The hard truth: It’s possible, but not easy

It’s a pretty well-known fact that a small number of crypto day traders achieve consistent profitability. Nearly 95% of retail traders lose money in their first year, highlighting the significant challenge ahead. Professional traders typically aim for modest 1-2% daily returns rather than chasing massive gains. As cryptocurrency analyst Jake Thompson notes, “Sustainable day trading isn’t about hitting home runs but making consistent contact with the ball”.

Successful crypto trading demands a substantial time commitment – professional traders spend 6-8 hours daily monitoring charts, analyzing news, and executing trades. This isn’t passive income but rather a full-time endeavor requiring discipline and patience.

Why most traders fail

Most traders sabotage their success through several critical mistakes:

- Poor risk management: Professionals limit exposure to 1-2% per trade while beginners often risk 10% or more on single positions

- Emotional trading: Fear and greed drive impulsive decisions, with panic selling during dips and FOMO buying at peaks

- Unrealistic expectations: Chasing 10%+ daily returns instead of sustainable 1-3% targets

- Overtrading: Excessive trading increases fees that quickly erode profits

- Inadequate security: Underestimating the importance of securing crypto assets

Trading psychology separates the successful 4% who make a living from the unsuccessful majority. Without emotional discipline and a well-defined strategy, you’re essentially gambling rather than trading.

What this guide will actually teach you

Instead of promising overnight riches, this guide presents a clear “Trader’s Pathway” from foundational strategies to advanced techniques. You’ll learn:

- How to build proper risk management fundamentals

- Realistic pathways for different risk tolerances and time horizons

- Capital-efficient approaches like prop trading for those with skill but limited funds

- Step-by-step implementation of proven strategies from HODLing to day trading

We’ll focus on actionable methods rather than hype, because cryptocurrency trading success comes from education and discipline, not luck or timing. The guide prioritizes sustainable approaches that professional traders actually use, not get-rich-quick schemes that lead most beginners to failure.

Remember that cryptocurrency trading involves substantial risk. Although the potential rewards exist, they come only to those who approach trading with proper preparation and realistic expectations.

The Foundation: 3 Things You MUST Do Before You Trade $1

Before you rush to buy your first cryptocurrency, establish these three critical foundations. Successful traders understand that preparation before action separates professionals from the masses who lose money.

Master your risk: Stop-losses, position sizing, and capital allocation

First and foremost, proper risk management should be implemented by establishing clear stop-loss orders, which are automated sell triggers that activate when prices fall to predetermined levels. These orders limit your potential losses and remove emotional decision-making during market downturns.

Position sizing represents the cornerstone of risk management. Professional traders follow the 1-2% rule, never risking more than 2% of their total trading capital on any single position. For a $10,000 account, this means limiting potential losses to $100-$200 per trade.

To calculate your position size:

Position Size = (Risk Tolerance % × Account Size) ÷ (Entry Price – Stop-Loss Price)

For example, with a $25,000 trading account and 2% risk tolerance ($500), trading Tesla at $225 with a stop-loss at $195 would allow for approximately 16 shares. This disciplined approach ensures that even after a string of losses, your trading capital remains largely intact.

Choose a reputable exchange: What to look for

Selecting the right cryptocurrency exchange significantly impacts your trading experience and security. After the FTX collapse in 2022, exchange reliability has become paramount.

When evaluating exchanges, consider these critical factors:

- Regulatory compliance: Exchanges with multiple licenses across jurisdictions offer greater protection

- Security features: Two-factor authentication, data encryption, and cold storage practices

- Fee structure: Trading fees, deposit/withdrawal fees, and conversion costs

- Customer service: Responsiveness and multiple support channels

- Track record: History of security breaches and remediation measures

Some top-rated security and reliability exchanges include Coinbase, Binance, Gemini, Kraken, and Bitstamp. These platforms have built strong reputations through consistent performance and robust security measures over the years.

Secure your assets: Hot vs cold wallets explained

Cryptocurrency security extends beyond exchange selection to proper wallet management. Understanding the difference between hot and cold wallets is fundamental.

Hot wallets remain connected to the internet, making them convenient for frequent trading but more vulnerable to attacks. These software-based wallets generate and store your private keys online, creating inherent security risks despite their accessibility.

Conversely, cold wallets store your private keys completely offline, significantly reducing vulnerability to hacking. Hardware cold wallets typically resemble USB drives, costing between $50-$200. Their offline nature makes them ideal for storing larger cryptocurrency amounts that you don’t need to access regularly.

For optimal security, implement a two-wallet strategy: use hot wallets for small amounts needed for active trading and cold wallets for long-term holdings. This balanced approach provides both convenience and security while minimizing potential losses from security breaches.

Pathway 1: The Foundational Strategies (Lower Risk, Longer Time Horizon)

For traders seeking stability in the volatile crypto market, foundational strategies offer a lower-risk entry point with longer time horizons. These methods help you build wealth gradually while minimizing the emotional stress of market fluctuations.

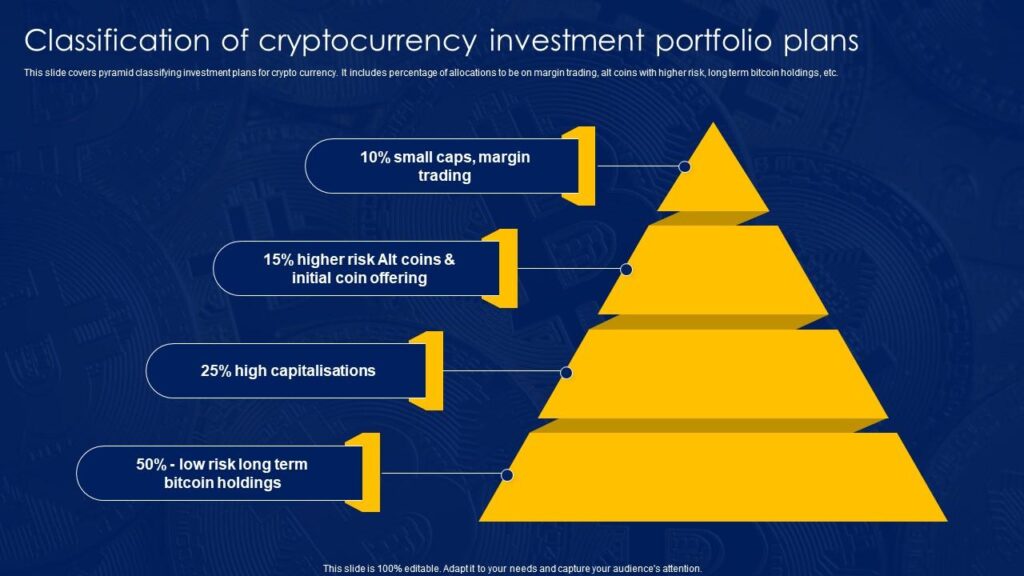

Image Source: Slideteam

Method 1: Buy and Hold (HODLing)

“HODL” – originally a misspelt forum post from 2013 that meant “hold”—has evolved into a cornerstone philosophy among crypto investors. This strategy involves purchasing cryptocurrency and holding it for extended periods, potentially years or even decades.

The HODL approach works particularly well for investors who believe in a cryptocurrency’s long-term utility and adoption. Furthermore, it eliminates the need to monitor markets or master technical analysis constantly. Historical examples demonstrate its effectiveness: a mere $1,000 investment in Bitcoin in 2010 would have grown to more than $1 billion today.

HODLing provides several advantages over active trading:

- Lower stress and fewer transaction fees

- Potential tax advantages for long-term holdings

- Reduced emotional decision-making during market volatility

Nevertheless, successful HODLing requires thorough research into a cryptocurrency’s fundamentals, utility, and tokenomics before investing. Most financial experts recommend limiting crypto exposure to less than 5% of your total investment portfolio, with beginners starting at just 1-2%.

Method 2: Staking & Earning Interest

Staking represents a powerful way to generate passive income while holding cryptocurrency. This process involves committing your crypto assets to support a blockchain network’s operations and security. In return, you earn staking rewards—essentially interest on your holdings.

Platforms like Kraken distribute staking rewards twice weekly, with popular coins such as Tezos (XTZ) and Cosmos (ATOM) offering returns between 5-20%. To begin staking:

- Purchase a proof-of-stake cryptocurrency

- Select the asset on your chosen exchange

- Commit your tokens to the staking pool

Consequently, many exchanges offer “flexible” terms allowing withdrawal at any time, though some require lock-up periods of 30-120 days.

Despite its benefits, staking carries risks, including potential “slashing” penalties if the network experiences issues. Additionally, staked tokens may be locked for periods, limiting liquidity during market movements.

How to start with Dollar Cost Averaging (DCA)

Dollar Cost Averaging forms the perfect complement to both HODLing and staking. This strategy involves investing fixed amounts at regular intervals regardless of price fluctuations.

To implement DCA effectively:

- Decide on a fixed amount you can comfortably invest regularly

- Set up automated purchases (weekly or monthly)

- Maintain discipline regardless of market conditions

- Consider opportunistic extra purchases during significant dips

DCA removes the psychological burden of trying to “time the market” and helps mitigate the impact of crypto’s notorious volatility. Given the cyclical nature of crypto markets, this approach helps you accumulate more coins during price drops and fewer during peaks, potentially lowering your average purchase price over time.

Remember that DCA works best when you believe the underlying asset will appreciate long-term. It doesn’t guarantee profits or prevent losses in declining markets, but simply provides a disciplined framework for building your crypto position methodically.

Explore our beginner-friendly guide on how to DCA in crypto to understand the basics at your own pace.

Pathway 2: The Active Trading Strategies (Higher Risk, Higher Potential)

Ready to step up your trading game? Active trading strategies offer higher potential returns but come with increased risk and time commitment. These approaches demand more hands-on management than foundational methods.

Method 3: Day Trading Crypto – Tools and time commitment

Day trading cryptocurrency requires significant dedication–successful traders typically spend numerous hours daily monitoring markets. This high-intensity strategy involves making multiple trades within a single day to capitalize on short-term price movements.

Effective day traders rely on technical indicators to make data-driven decisions:

- RSI (Relative Strength Index) to identify overbought/oversold conditions

- MACD (Moving Average Convergence Divergence) to confirm trend direction

- EMAs (Exponential Moving Averages) for detecting short-term signals

Notably, professional day traders aim for modest 1-2% daily returns rather than chasing unrealistic gains. Success demands discipline – start with demo accounts to test strategies without risking real money, always set stop-loss orders, and limit trading time to avoid burnout.

Method 4: Swing Trading Crypto – Using Moving Averages

Swing trading strikes a balance between day trading and long-term holding, with positions typically held for several days to weeks. This approach allows you to capitalize on “swings” in market momentum without requiring constant monitoring.

Moving averages serve as primary tools for swing traders:

- Simple Moving Average (SMA) helps identify overall trends

- Exponential Moving Average (EMA) gives more weight to recent prices

- Moving Average Crossovers signal potential trend changes

Successful swing traders frequently utilize the 21, 50, and 200-period moving averages, looking for “golden crosses” (50-day EMA crossing above 200-day EMA) to identify multi-day rallies.

Method 5: Cryptocurrency Arbitrage – How it works and tools needed

Cryptocurrency arbitrage involves exploiting price differences of the same asset across different exchanges, i.e. buying at a lower price on one platform and simultaneously selling at a higher price on another.

Common arbitrage strategies include:

- Cross-Exchange Arbitrage: Trading between different platforms

- Triangular Arbitrage: Exploiting price inconsistencies between trading pairs

- Decentralized Arbitrage: Leveraging differences between DEXs and CEXs

While generally considered lower-risk than other active strategies, arbitrage requires rapid execution and careful calculation of fees to ensure profitability. Moreover, several tools are available to help traders spot and seize these short-lived opportunities with greater ease.

Crypto Prop Trading: A Capital-Efficient Path for Skilled Traders

Even skilled traders often face a frustrating reality: talent without sufficient capital to maximize profits. This is where crypto prop trading comes into play as a game-changer for serious traders.

The Trader’s Dilemma: Skill without capital

Consider this scenario: you’ve mastered trading strategies, but your $1,000 account severely limits potential returns. A 10% monthly return yields just $100, hardly a life-changing income despite your expertise.

Method 6: What is Crypto Prop Trading?

Crypto proprietary trading means trading with a firm’s capital instead of your own. These firms provide funding, often up to $200,000, while you keep a significant share of profits, typically 70-90%. The process works through a simple framework:

- Apply and qualify by passing an evaluation in a demo environment

- Receive funded account access upon success

- Trade according to the firm’s guidelines

- Scale up as you demonstrate consistency

Who is Prop Trading for?

Prop trading suits traders who:

- Have proven strategies, but insufficient capital

- Can follow structured risk parameters

- Demonstrate consistent profitability

- Seek faster scaling possibilities

A trader with a $100,000 funded account achieving just a 10% annual return could potentially earn $10,000 monthly while risking nearly $0 of personal capital.

Pros & Cons of becoming a funded crypto trader

Advantages:

- Trade without personal financial risk

- Access significantly larger positions

- Structured risk management prevents reckless trading

- Faster scaling through increased allocations

Disadvantages:

- Firms take profit cuts (10-30%)

- Strict risk parameters limit trading freedom

- Evaluation processes can be challenging

- Some firms restrict certain trading styles

How CryptoPropTrader Helps You Get Started

Choosing the right prop firm can be challenging, especially with many options offering different promises. Whether you’re new to funded trading or a seasoned trader looking to scale, knowing which firm to trust is critical. This is where CryptoPropTrader comes in.

Instead of spending hours researching individual firms, CryptoPropTrader gives you a clear overview of the top options in one place. You can easily compare funding models, evaluation rules, fees, profit splits, and more. The goal is to simplify your decision-making process so you can focus on finding a firm that fits your trading style and objectives.

Each firm listed on the platform includes detailed information on challenge formats, minimum requirements, and community reviews. This helps traders avoid low-quality or untrustworthy firms and instead focus on reputable options that align with their goals. It is especially useful if you are just getting started or if you want to explore alternatives after facing setbacks with other firms.

Understand the Tax Side of Funded Trading

If you’re trading with a funded account, don’t overlook the tax angle. Many countries classify trading gains as either personal or business income, and in some cases, costs like evaluation fees or trading tools might qualify as write-offs. Since tax laws vary across regions, staying on top of your local guidelines is crucial. You can check the IRS’s official guidance on virtual currencies for more clarity.

To avoid surprises later, consider consulting a tax professional who specializes in trading. They can help you file the right way and ensure you’re making the most of any eligible deductions. Proper planning now can save you a lot of trouble down the line.

Bonus Method: Earning Through Airdrops & Bounties

While this guide focuses mainly on earning through crypto trading, it’s worth exploring a few additional ways to generate income in the crypto space. Beyond active trading, there are a few alternative methods to earn crypto without making a direct financial investment.

Method 7: Airdrops and Bounties

Crypto airdrops are marketing strategies where blockchain projects freely distribute tokens to wallet addresses. This approach helps startups bootstrap awareness and encourages early adoption of their projects. Typically, you’ll receive small amounts of new virtual currency for free or after completing simple tasks like retweeting posts or joining Telegram channels.

Unlike mainstream marketing that relies on advertising, airdrops utilize decentralized distribution methods, sending tokens directly to your crypto wallet. Most airdrops follow a standard process: announcement of details, registration by providing your wallet address, verification of eligibility, and finally, distribution of tokens.

Bounty programs offer another pathway, requiring more active participation. These campaigns reward users for completing specific promotional activities or technical tasks. Tasks range from creating content about the project to identifying software bugs. Bounty hunters with specific skills in coding, design, or content creation often find more lucrative opportunities.

Remember that legitimate airdrops never seek capital investment; their purpose is purely promotional. Yet, exercise caution as some airdrops serve as pump-and-dump schemes. Furthermore, while stories of massive airdrop values exist, most rewards are modest, typically less than $20.

To maximize safety, research projects thoroughly before participating, verify through official channels, and avoid connecting to unfamiliar websites. Consider creating a separate wallet specifically for airdrops to isolate potential risks from your primary investments.

Conclusion: Choose Your Path and Start Learning

The cryptocurrency market presents both tremendous opportunities and significant challenges for traders. Throughout this guide, we’ve navigated the complete spectrum of crypto trading strategies, from conservative approaches like HODLing and staking to more active methods such as day trading and arbitrage. Undoubtedly, successful crypto trading demands more than just downloading an app; it requires education, discipline, and proper risk management.

Remember that the foundation of trading success starts with the basics: implementing strict risk parameters, choosing secure exchanges, and properly protecting your assets. Additionally, your trading strategy should align with your risk tolerance and time commitment.

For traders who have built skill but lack significant starting capital, one path deserves more attention than it gets: crypto prop trading. This model gives you access to institutional-level funding without putting your own money at risk upfront. In return, you keep a large portion of the profits you generate. If you’re confident in your strategy and ready to scale your trading, prop trading could be the bridge between your talent and meaningful capital.

Ready to prove your skill and trade with serious capital? Explore our complete breakdown of the Best Crypto Prop Trading Firms to find the right fit for your strategy.