How to Get a Funded Trading Account

Every trader wants to grow, but not everyone has the capital to take bigger positions. Whether you’re in stocks, forex, or crypto, the challenge is the same: how do you scale without putting your own savings at risk?

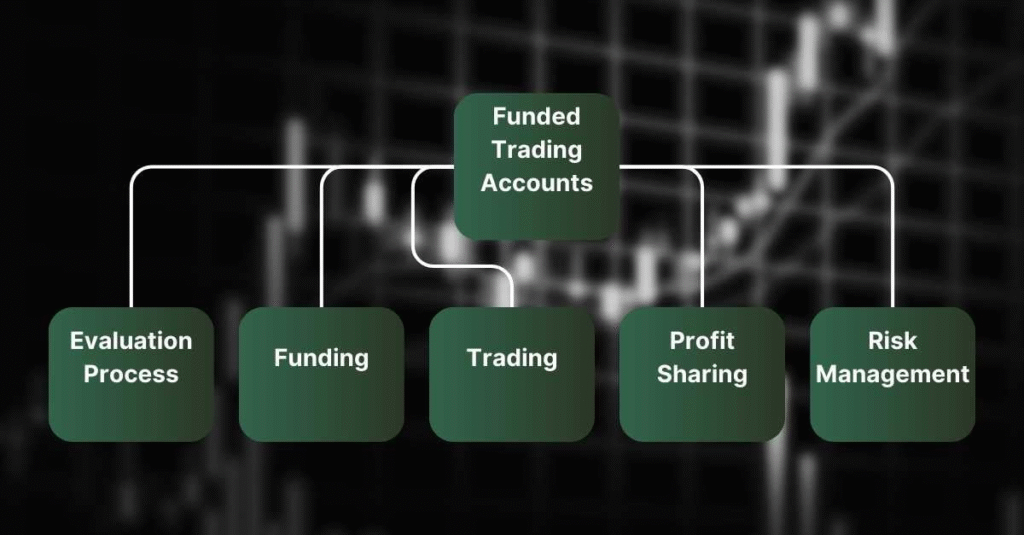

That’s where funded trading accounts come in. These accounts are backed by proprietary firms that let you trade with their capital. You keep a share of the profits while following their risk rules.

In this guide, you’ll learn exactly how funded accounts work, how to get approved, and how to turn your trading skills into long-term income. No jargon. Just clear insights, proven strategies, and trusted resources to help you get started.

Why Funded Trading Accounts Matter

Retail traders typically start with small capital, which limits their ability to take significant positions or withstand market declines. The emotional pressure intensifies when every dollar is personally at risk, making mistakes potentially wipe out weeks of gains. This is a key reason why technically proficient traders often face difficulties in achieving growth.

A funded trading account provides a way to overcome this constraint. In simple terms, a funded account is capital provided by a proprietary (prop) trading firm. You trade their capital under specific risk parameters. If you succeed, you will retain a percentage of the profits. If you fail, the firm covers the loss up to a pre-agreed threshold. It’s a win-win if approached with discipline.

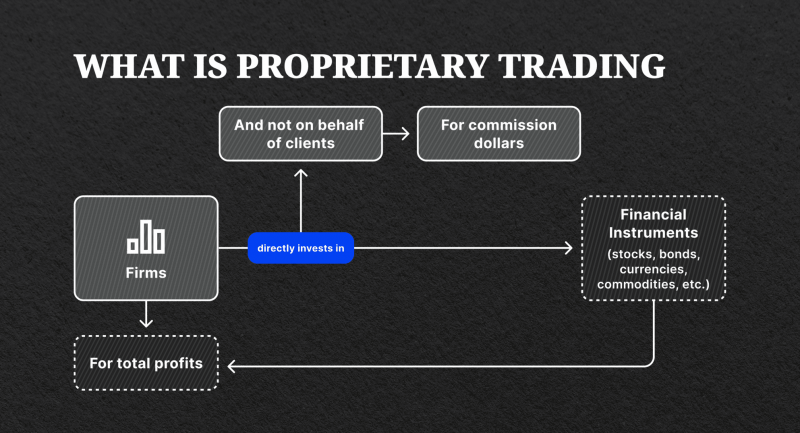

Earlier, proprietary trading traditionally involved firms using their own capital to trade for profit. However, the model has evolved, and today, many firms extend this opportunity to skilled retail traders via evaluation programs.

What Is a Funded Trading Account?

A funded trading account is an account provided by a proprietary trading firm that lets you trade with their money instead of your own. You follow their rules, trade their capital, and earn a share of the profits. It’s a way to trade professionally without risking your personal savings.

The firm sets risk limits, such as how much you can lose in a day, the maximum drawdown allowed, and how many days you must trade. To qualify, you usually need to pass a challenge. This means trading in a demo account under real market conditions. If you meet the targets, the firm gives you a live account with real capital.

The profit-sharing structures differ across proprietary trading firms. Depending on the firm, traders might retain anywhere from 70% to 90% of the profits. The rest goes to the firm as compensation for putting their capital at risk. This model creates a strong alignment of interests between the trader and the firm.

Prop Firm Models Explained

Proprietary trading firms typically operate on evaluation-based models. The most common is the two-step evaluation. In the first phase, traders must achieve a predefined profit target, usually between 5% to 10%, while adhering to strict rules around daily losses and maximum drawdowns. Those who pass move on to the second phase, often called the verification phase, where similar or slightly easier targets are used to assess consistency.

Another model is instant funding. Traders pay a higher upfront fee to access a live funded account without completing the evaluation stages. However, these accounts often come with stricter risk limits, such as tighter drawdowns and smaller maximum position sizes.

Prop firms sustain their business through a combination of challenge fees, technology partnerships, and a share of trading profits. Evaluation fees contribute to covering operational costs and risk management, especially given the selective nature of the funding process. For those who do succeed, the firm earns a percentage of profits from capital that it controls, while maintaining defined risk exposure.

This structure allows firms to back skilled traders while managing risk and generating revenue in a sustainable, performance-driven model.

Hybrid or scaling programs take a middle path. You begin with a smaller funded amount, and as you hit predefined profit milestones, your account size increases. These models reward long-term consistency and are often preferred by swing and position traders who aren’t aiming for quick wins but rather for stable monthly gains.

Crypto Prop Trading Gaining Traction

Within the world of funded trading, crypto is quickly emerging as one of the most promising markets. As digital assets become more mainstream, traders are increasingly drawn to this market for its extreme volatility, 24/7 trading hours and massive price swings. Unlike traditional markets, crypto can move 10 to 20 percent in a matter of hours, offering more frequent and larger trade opportunities.

This volatility, while risky, is precisely what makes crypto appealing to skilled traders. Many proprietary trading firms now offer specialized crypto funding programs, tailored to meet the demands of this volatile asset class. With access to institutional-grade capital, traders can scale their strategies and tap into larger profit potential while following strict risk management rules.

Detailed Guide: How to Become a Funded Trader

Getting funded by a proprietary trading firm isn’t just about passing a challenge. It starts with understanding who you are as a trader and what kind of environment will allow you to perform at your best.

Here are five quick steps to help you find the right fit and increase your chances of getting funded successfully.

Step 1: Understand Your Own Trading Profile

Before you start your journey, you need clarity on your trading style. Are you someone who prefers short bursts of trades throughout the day, or do you like holding positions for several days or even weeks? Scalpers, for example, will need firms that allow high-frequency strategies, whereas swing traders must ensure that overnight positions are permitted. Your strategy defines what kind of firm and funding program will work for you.

Another vital aspect is risk tolerance. Some traders are comfortable with a 2% risk per trade, while others prefer to stay below 1%. Your tolerance for drawdown, emotional reactions to losses, and comfort level with high leverage should all be factored into choosing a prop firm.

Step 2: Research and Shortlist Reputable Firms

Not all prop firms are created equal. Transparency, customer support, community reputation, and fee structures can vary widely. For instance, some firms offer extensive educational content and mentorship as part of their programs, while others simply provide the challenge and the funding.

The best approach is to compare features and user reviews across platforms, and sites like CryptoPropTrader offer in-depth analysis to help you make an informed decision. Check each firm’s rulebook. Some require you to trade a minimum number of days, while others are more lenient. Review their drawdown policies, profit targets, and scaling opportunities.

Step 3: Practice on a Demo Before the Challenge

Use the firm’s demo environment to simulate the evaluation. Trade as though it’s real. Maintain a trading journal to log your wins and losses and refine your trading strategies. This phase is crucial for understanding how you perform under rules and constraints.

Monitor key metrics such as win rate, risk-reward ratio, and max drawdown. Get comfortable with the platform’s UI/UX. Also, prepare emotionally. Challenges are as much psychological as they are technical. You’re being evaluated under pressure, so get used to it before the stakes are real.

Step 4: Attempt the Challenge with a Professional Mindset

Once you’re confident, pay the entry fee and begin your evaluation. Follow your trading plan. Risk management is critical; use fixed fractional sizing, avoid revenge trading, maintain journals and stick to your setup criteria.

If your target is 8%, don’t aim for 20%. The goal is to pass, not to impress. Overreaching is one of the main reasons traders fail these evaluations. Keep in mind that even after getting funded, your performance is monitored. Building discipline during the challenge phase sets the tone for long-term success.

More recently, a 2023 study in Management Science backed this up, showing that traders who were more aware of their actions and emotions tended to make better decisions and earn higher returns.

Step 5: Stay Funded and Scale Your Account

Getting funded is just the first step. Staying funded is where the real challenge begins. Many traders lose their accounts early by straying from their strategy or getting overconfident after a few wins. Prop firms usually have strict consistency rules, so even one rough week can set you back or delay your chances of scaling up.

Stick to what got you there. Climb up only when you hit profit milestones. Continue to log trades and assess emotional responses. Join trader communities for accountability and continued learning. Funding is a gateway to a career, not a finish line.

Why CryptoPropTrader Is the Smartest Place to Start

One of the most common challenges for both new and experienced traders is determining which prop firm to trust. This is where CryptoPropTrader.com plays a crucial role. Rather than being a proprietary trading firm itself, CryptoPropTrader is a discovery and comparison platform that helps traders find the best funded trading programs available globally.

CryptoPropTrader helps you quickly compare the top proprietary trading firms in one place. Instead of spending hours researching each firm, you get a clear breakdown of their funding models, trading rules, fees, and profit splits. The goal is to make it easier for traders to choose the right firm based on their needs. Whether you’re just getting started or a pro-trader, the platform offers structured insights to help you make smarter decisions faster.

Each listed firm includes transparent breakdowns of challenge structures, minimum requirements, and even community reviews. Traders can avoid scams and low-reputation firms, saving both time and money. It’s especially helpful if you’re just starting out or if you’ve failed previous evaluations and want to explore alternatives with better terms.

By centralizing this information, the platform empowers you to focus on your trading while it does the research heavy lifting. It’s not just a directory; it’s a tool designed to match you with the best funding pathway for your unique trading profile.

Regulations and Taxes: Stay Compliant

When trading with a funded account, it’s important to be aware of how local rules might apply to your profits. Most countries treat trading income as personal or business income. In some cases, fees paid for evaluations or tools could be considered deductible. While exact rules vary depending on where you live, the key is to stay informed and keep your records in order.

It’s a good idea to speak with a tax advisor who understands how trading income works. They can guide you on how to report your earnings correctly and what expenses you might be able to write off.

Final Thoughts

Getting a funded trading account is a big milestone, but it’s just the beginning. Many traders lose out not because they lack skill, but because they treat the process too casually. Overtrading, breaking rules, or chasing losses are common reasons for failure. Success in prop trading isn’t about luck or shortcuts. It’s about sticking to a plan, managing risk, and showing up with discipline every day.

With time, the prop trading landscape has changed, and crypto is leading that change. With around-the-clock markets, low entry barriers, and real-time access to global assets, crypto prop trading offers modern traders more flexibility than ever before.

If you’re serious about trading and want to grow without risking personal capital, this is your chance to build something long-term. Visit CryptoPropTrader.com today to find the prop firm that suits you best.