Crypto Prop Trading Strategies That Work: Guide

For years, crypto trading has attracted dreamers hoping to turn small accounts into life-changing wealth.

But here’s the harsh reality: the majority of retail traders blow up their accounts long before they ever achieve financial independence. What if there were a way to trade without risking your own money, yet still access professional-level capital?

That’s where crypto prop trading firms come in. These firms provide skilled traders with access to large pools of capital, ranging from $10,000 to over $1 million, and split profits with them. Instead of bootstrapping your growth, you use their capital while focusing purely on executing profitable strategies.

But, prop firms keep strict rules in check to ensure their capital is protected. They impose drawdown limits, time-constrained profit targets, leverage caps, and restrictions on trading frequency or instruments. These rules mean that retail strategies often fail spectacularly under these conditions.

This guide will break down five prop firm-optimized crypto strategies that are designed not just to pass funding challenges but to thrive within them. You’ll learn about low-risk scalping, swing trading for multi-day gains, event-driven volatility trading, statistical arbitrage, and mean reversion in ranging markets.

Along the way, we’ll explore success metrics, practical tools, and real-world examples that show how you can avoid becoming another failed statistic.

Why Standard Crypto Strategies Fail?

Even experienced retail traders struggle with prop challenges. The issue isn’t always a lack of skill but rather a lack of alignment with the strict institutional constraints imposed by these firms. Retail tactics often ignore critical rules like drawdown limits, time-based profit targets, and trading restrictions.

In 2025, a QuantVPS study revealed that only 8% of prop firm traders pass their first evaluation, and just 2% consistently withdraw profits. This isn’t because they’re bad traders; it’s because they aren’t prepared for the environment. Many of these failures are avoidable.

The most common reasons include exceeding drawdown thresholds, mismanaging leverage, overtrading, and holding positions overnight when the firm’s rules prohibit it. These mistakes aren’t simply technical errors; they are structural mismatches between strategy design and the operational environment of a prop firm.

The Max Drawdown Trap

Managing drawdown is not optional in prop trading. It’s a rule you must follow if you want to stay in the game. Most prop firms set strict loss limits. For example, if your account drops by 5% in a single day or by 10% overall, your account can be closed immediately.

The real danger starts when traders try to recover losses quickly by increasing their trade size. This emotional reaction usually leads to bigger losses. Experienced traders try to control risk from the start. We advise risking only 1% to 2% of an account in a day. The idea is to stay calm, stick to the plan, and never let emotions take over.

Leverage Reality Check

Crypto trading offers high leverage, but using too much can wipe out your account in minutes. While crypto exchanges might allow leverage of up to 100X, funded traders rarely approach those extremes.

Most successful scalpers and swing traders in prop firm environments prefer conservative leverage, typically between 2X and 5X. This measured approach sacrifices potential speed but dramatically improves survival odds.

Using lower leverage helps traders stay within risk limits and avoid unnecessary drawdowns. Most funded traders also keep their risk per trade very low, often around 0.5% to 1% of their account. This steady, cautious method helps them clear evaluation stages and stay funded longer, without taking big risks that could lead to disqualification.

Instrument and Time Restrictions

Trading freedom is a luxury in retail accounts but is often heavily constrained in prop firms. Many of the best crypto prop trading firms restrict the types of assets you can trade, forbidding highly volatile meme coins or limiting exposure to altcoins during certain hours of the day. Some firms disallow holding positions overnight or over weekends to prevent unexpected losses due to low liquidity or market gaps.

Strategies relying on unrestricted access will inevitably clash with these operational boundaries. For example, a scalper who expects to execute 40 trades per day may be frustrated by firm-imposed trade limits that allow no more than ten trades in a 24-hour period. Traders must understand these rules before attempting to deploy their strategy.

Top Crypto Prop Trading Strategies: What Works

When it comes to crypto prop trading strategies, success depends on more than just market knowledge. You need a structured approach that works within the rules of prop firms. Let’s break down some of the most reliable strategies used by funded traders today.

Core Strategy 1: Low-Risk Scalping for Daily Consistency

Scalping has always been an attractive strategy for crypto traders because of the market’s inherent volatility and its round-the-clock operation. However, within prop firms, the emphasis shifts from sheer speed to calculated precision.

Funded scalpers wait patiently for high-probability setups on one-minute or five-minute charts during periods of peak liquidity, such as when the London and New York trading sessions overlap. They typically risk no more than 0.5–1% of their account balance on each trade. With tight stop-losses and clearly defined targets, these traders aim for reward-to-risk ratios of at least 2:1, compounding small gains over time.

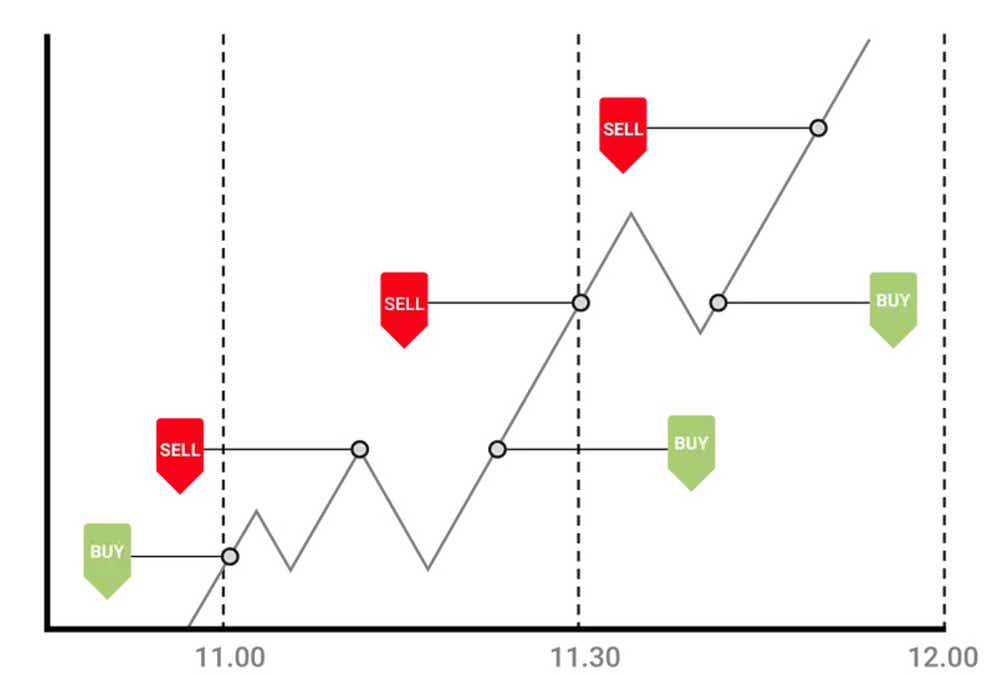

Scalp Trading Strategy, Source: Tastylive

An example trade might involve spotting a breakout retest. On a $50,000 account, the trader risks $250 (0.5%) with a stop-loss set tightly below the entry point. A successful trade targeting a 1% gain nets $500. Over a month, consistent execution of just two or three such trades per day can achieve a 5–7% account growth, satisfying most firms’ profit targets.

Scalping in prop firms also demands the right tools and platforms. Traders use charting tools like TradingView for precision technical analysis and rely on low-latency brokers that offer tight spreads and instant order execution.

The psychological aspect of scalping cannot be overlooked. Success requires waiting for “A+ setups” and avoiding the temptation to overtrade. Many prop firms penalize overtrading, so funded scalpers often impose personal limits of three to five trades per session, ensuring they operate within the rules.

Core Strategy 2: Swing Trading for High-Conviction Moves

Swing trading appeals to traders who prefer a slower, more analytical approach. Instead of seeking quick gains, swing traders analyze four-hour or daily charts to identify high-conviction trades that can play out over several days.

To make swing trading prop firm-compatible, traders use advanced risk management techniques. Stops are often placed using Average True Range (ATR) to account for normal volatility, and position sizes are kept modest to avoid breaching drawdown thresholds during overnight gaps or weekend news events.

Partial profit-taking at key technical levels and trailing stop-losses help secure gains while still allowing for larger moves.

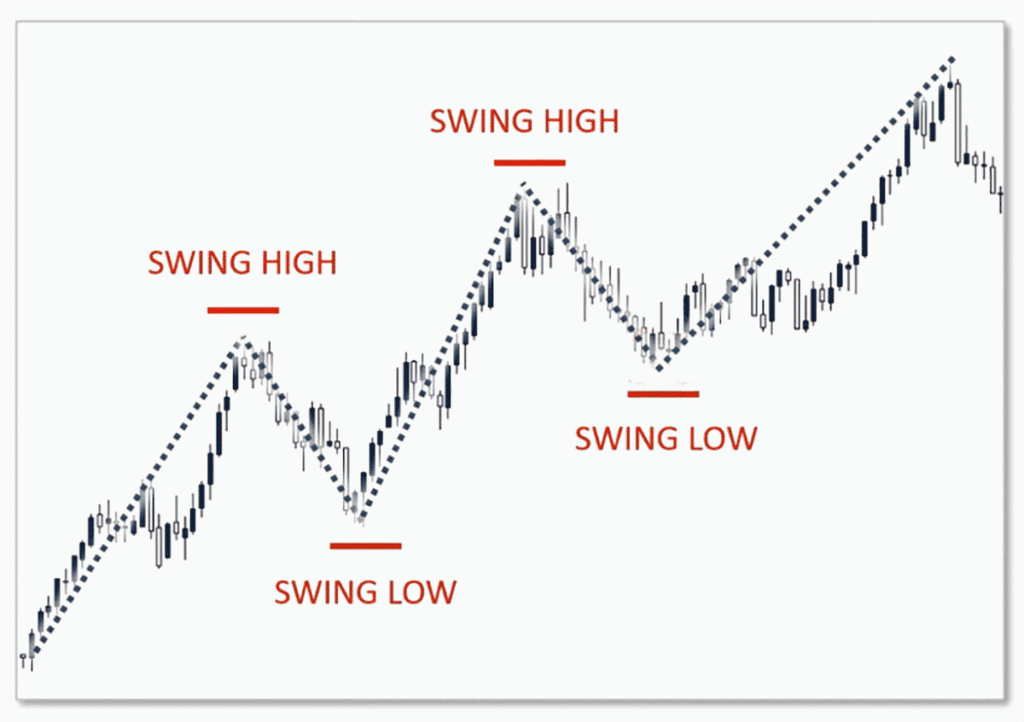

Swing Trading Setup, Source: 2nd Skies Trading

For example, a trader might spot a bullish flag pattern on ETH/USD’s daily chart. Entering at $2,000 with a stop-loss at $1,950 (2.5% risk) and a target of $2,200 (5% reward), they align their trade size to limit risk to 1% of their total account balance. A successful trade of this type on a $100,000 account can yield $5,000, potentially meeting the firm’s profit target in a single swing.

However, swing traders must carefully evaluate a prop firm’s policies on overnight and weekend holds. Some firms allow these positions but impose higher rollover fees, while others forbid them entirely. Matching your strategy to your firm’s operational model is critical to success.

Core Strategy 3: News and Event-Driven Volatility Trading

Crypto markets are notoriously sensitive to news. A single tweet, policy announcement, or protocol upgrade can send prices soaring or tumbling within minutes. This volatility makes event-driven trading an incredibly powerful tool for traders operating under prop firm constraints, if executed with discipline.

Event traders begin by building a calendar of high-impact events. These might include major token unlocks, regulatory decisions such as Bitcoin ETF approvals, or macroeconomic news like U.S. Federal Reserve interest rate changes. Unlike retail traders who often dive in impulsively, prop traders understand the importance of waiting for confirmation before committing capital.

A sound event-trading plan involves patiently monitoring the market’s initial reaction to news, then entering only after the first wave of volatility settles. For example, a trader watching for an ETF approval might wait for a one-hour candle to close above a key resistance level before taking a long position. This approach reduces the risk of being whipsawed during the chaotic first few minutes following a major announcement.

Risk management is particularly crucial in this strategy. Successful event traders keep position sizes modest, ensuring that even if the market reverses sharply, they remain well within their firm’s drawdown limits. Tight stop-losses and clearly defined profit targets help further protect their account.

In early 2025, a funded trader capitalized on Bitcoin’s rally after an ETF approval was announced. By waiting for the breakout retest and entering with a conservative 0.5% account risk, the trader secured a 7% move in their favour, well within the firm’s rules and sufficient to pass their profit target in a single trade.

To succeed in event-driven trading, you’ll need the right tools. Real-time news aggregators like CryptoPanic and funding rate trackers like Coinglass help you anticipate market-moving announcements. Combining these with a fast execution broker ensures you don’t miss crucial entry windows.

This strategy requires patience and composure under pressure. Prop firms value traders who can stay calm during major events because this quality signals an ability to manage risk in high-stakes situations.

Core Strategy 4: Statistical Arbitrage (Pairs Trading)

Statistical arbitrage, often called pairs trading, is a market-neutral strategy that relies on price relationships between correlated assets. Unlike directional strategies that bet on market movement, pairs trading profits from the convergence or divergence of two assets, making it particularly well-suited to prop firm environments where risk management is paramount.

The concept is simple but needs careful execution. Traders look for pairs of crypto assets, like ETH and BTC, that usually move together. When their price relationship shifts noticeably from the usual pattern, the trader takes a position expecting the prices to move back to their normal range.

For example, if ETH significantly underperforms BTC, the trader might go long on ETH and simultaneously short BTC, profiting as the spread narrows.

The repetitive nature of monitoring spreads and executing rebalances raises a critical operational question: Can you use trading bots or EAs in a crypto prop firm? The answer hinges entirely on your chosen firm’s policy. Some firms explicitly permit automation, often requiring disclosure during registration. Others strictly prohibit bots during the evaluation phase, while a third category allows them only after securing a funded account.

A critical component of this strategy is determining entry and exit points. Traders use statistical tools like z-scores to measure deviation from the mean, often entering when the spread moves beyond two standard deviations and exiting once it reverts to the mean. Stop-losses are set to manage the risk of continued divergence, ensuring the trade stays within the prop firm’s limits.

One of the reasons prop firms favour pairs trading is its inherently low exposure to broad market movements. Because the strategy hedges one position against another, it minimizes directional risk and provides a smooth equity curve, exactly the kind of consistency prop firms want to see in funded traders.

In practice, pairs trading requires advanced tools. Correlation matrices, custom indicators, and access to platforms that support simultaneous long and short positions are essential. Many quantitative traders even develop API-based bots to automate their crypto prop trading strategies, ensuring precision in fast-moving markets.

By focusing on relative value rather than absolute price direction, statistical arbitrage provides a sophisticated and prop firm-approved way to achieve steady gains with minimal drawdowns.

Core Strategy 5: Mean Reversion on High-Volume Altcoins

When crypto markets enter periods of sideways consolidation, mean reversion strategies often outperform trend-following approaches. This strategy involves entering trades when an asset’s price deviates sharply from its historical average, with the expectation that it will return to the mean.

Mean reversion works best on mid- to large-cap altcoins that exhibit predictable ranges. Traders monitor indicators like the Relative Strength Index (RSI), Bollinger Bands, and moving averages to identify overextended conditions. For example, if an altcoin drops sharply, pushing the RSI below 30 and touching the lower Bollinger Band, a mean reversion trader might enter a long position anticipating a rebound.

This strategy’s effectiveness within prop firms lies in its controlled risk profile. Trades are typically small in size, with tight stop-losses and well-defined profit targets. By avoiding large overnight positions and focusing on intraday or short-term setups, mean reversion aligns perfectly with prop firm restrictions on drawdowns and overnight exposure.

A funded trader using mean reversion on LINK during a quiet market period demonstrated how effective this approach can be. After a sharp 15% dip intraday, the trader entered long with a tight stop and captured a 5% rebound. This one trade contributed meaningfully toward their monthly target while staying well within firm rules.

The key to success is knowing when mean reversion no longer applies. If an asset breaks out of its range and begins trending strongly, traders must exit promptly to avoid getting caught on the wrong side of momentum. Recognizing this transition is a hallmark of a skilled mean reversion practitioner.

Choosing the Right Crypto Prop Firm

Your strategy is only as effective as the platform you’re allowed to use it on. That’s why selecting the right prop firm is as important as the tactics you deploy. Scalpers should prioritize firms with ultra-low spreads, no trade frequency restrictions and instant order execution. These features reduce slippage and prevent performance penalties.

Swing traders should look for firms that allow holding trades over weekends and through overnight sessions. It’s also worth verifying that the firm doesn’t impose wide rollover fees or leverage reductions outside of normal trading hours. Event-based traders, meanwhile, need reliable execution during high-volatility periods, so platform uptime and order speed are critical.

For arbitrage and mean reversion strategies, your firm should offer a broad selection of crypto pairs, stable execution environments and support for both long and short trades. Some firms even allow API-based trading or bot integration, which can be a significant advantage for quantitative strategies.

Avoid any firm with vague rules, hidden fees, or poor support. Read trader reviews, test their platforms using free trials or demo environments, and compare them through resources like CryptoPropTrader.com. The platform makes it easier to navigate the crowded world of prop trading firms. Instead of digging through endless websites and reviews, traders get all the key details in one place. This includes funding structures, profit splits, evaluation rules, and platform fees.

Whether you’re new to trading or already experienced, the platform provides clear, side-by-side comparisons to help you find a firm that fits your trading style and goals. Every listing offers full transparency on challenge requirements, account rules, and real user feedback, helping you avoid unreliable firms and make confident decisions.

By handling the research for you, CryptoPropTrader allows you to focus on what matters most: your trading.

How to Choose a Prop Firm Based on Your Strategy

| Your Primary Strategy | Critical Firm Requirements | Firm Types to Prioritize | Firm Types to Avoid |

| Scalping / High-Frequency Trading | Ultra-low commissions, minimal slippage, lightning-fast execution, no minimum trading days, high-frequency trade allowance. | Firms with cutting-edge execution tech (often newer), crypto-focused platforms, and competitive fee structures. | Firms with high commissions, slow platforms, scalping restrictions, or trade frequency limits. |

| Swing Trading | Flexible timelines (30+ days), low/zero overnight fees, weekend holding permission, reasonable profit targets. | Firms with generous 1-step or 2-step challenges, transparent overnight/weekend policies. | Firms with ultra-short deadlines (e.g., 7 days for 10% target), high overnight fees, or weekend trading bans. |

| News/Event-Driven Trading | Explicit news-trading permission, robust infrastructure for volatility, minimal slippage during events. | Firms with proven platform stability during news events and transparent volatility-handling policies. | Firms banning news trading, frequent platform outages, or poor volatility management. |

| Statistical Arbitrage (Pairs) | Ultra-low fees (critical), diverse tradable pairs (spot & perps), simultaneous long/short allowance. | Firms with extensive altcoin pair listings, competitive fees, and API support for automation (if permitted). | Firms with high fees, limited pair selections, or restrictions on offsetting positions. |

| Mean Reversion (Altcoins) | Deep liquidity for top 50 altcoins, tight spreads beyond BTC/ETH. | Crypto-specialized firms with robust altcoin order books and consistent liquidity. | Firms offering only BTC/ETH, poor altcoin spreads, or illiquid altcoin markets. |

Conclusion: From Strategy to Funded Trader

Succeeding in the world of crypto prop trading requires more than just knowing how to read charts. This model does offer significant leverage, but is crypto prop trading inherently more profitable than retail trading? While it gives you access to more capital and limits your personal financial risk, long-term profitability still depends entirely on your skill, discipline, and ability to follow the rules.

It demands strategic alignment with the firm’s guidelines, sharp risk management, and a level of consistency that most retail traders never develop. Whether you’re scalping for quick gains, swinging for multi-day profits, or arbitraging price spreads between assets, the path to a funded account always starts with a clear plan and ends with disciplined execution.

Too many traders fail because they treat the evaluation like a game or rely on luck. The reality is that prop firms are looking for reliable partners, not high-risk gamblers. If you can prove that you understand the market, follow the rules and deliver repeatable performance, the opportunities for capital access, scaling and profit sharing are massive.

If you’re ready to take the leap, the next step is finding the right platform to back you. Visit CryptoPropTrader.com to compare the best crypto prop firms and start your journey toward getting funded.

Trading Risk Disclaimer:

Trading cryptocurrencies and derivatives through prop firms involves significant risk and may result in the loss of all capital. The crypto prop trading strategies shared here are for educational purposes. Do your own research and use proper risk management.